2024 401k Catch Up Rules. A key feature of 401 (k) accounts is that they have generous contribution limits. If you're age 50 or.

401k Catch Up 2024 Calculator Elle Willetta, Starting in 2024, the $1,000 amount will be adjusted annually for inflation just like the base amount. You can contribute more to your 401(k) once you reach age 50.

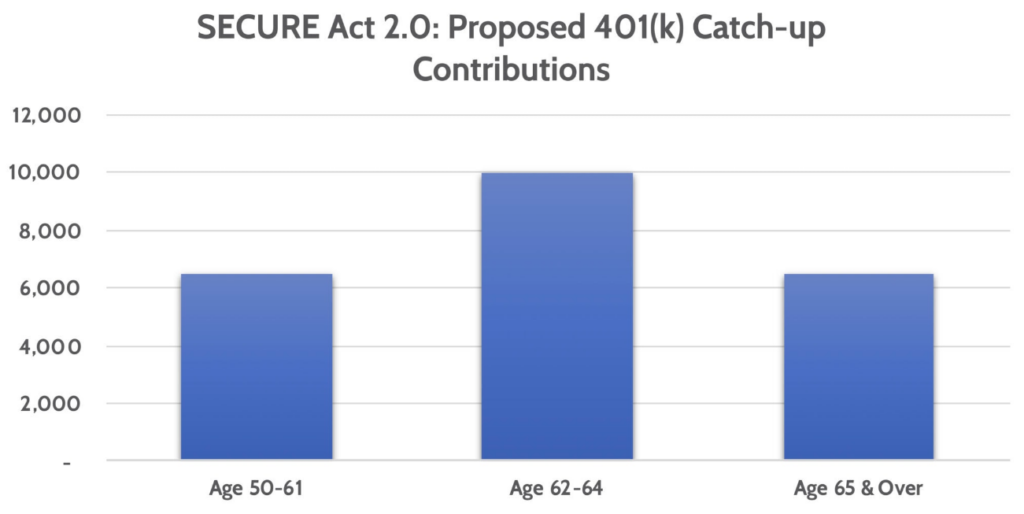

Irs 401k Catch Up Limits 2024 Terra, Secure act 2.0, passed last december, says any employee at least 50 years old whose wages exceeded $145,000 the prior calendar year and elects to make a so. In 2024, for example, if you’re enrolled in a workplace.

Max Catch Up 401k 2024 Keely Melessa, For 2024, you can put up to $23,000 into most workplace retirement plans. The 401(k) contribution limit for 2023 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

Irs Limits 401k 2024 Rene Vallie, The limit for overall contributions—including the employer match—is 100%. These limits are periodically adjusted for.

401k Catch Up 2024 Rules Bibby Belicia, If you participate in a. Ep wealth can help you navigate these.

401k Rules Changes 2024 Norry Antonina, Starting in 2024, the $1,000 amount will be adjusted annually for inflation just like the base amount. However, other irs updates may impact your retirement plan.

New 401(k) CatchUp Rules Start Next Year Investors Flocking to IRAs, A key feature of 401 (k) accounts is that they have generous contribution limits. For 2024, the maximum you can contribute from your paycheck to a 401 (k) is $23,000.

Solo 401k Roth Contribution Limits 2024 Lani Shanta, 401k catch up 2024 rules. You can contribute more to your 401(k) once you reach age 50.

New 401K Contribution Rules in 2024 You Need to Know YouTube, 401k catch up 2024 rules. A key feature of 401 (k) accounts is that they have generous contribution limits.

What Is The 401k 2024 Limit For Over 50 Ynez Analise, Specifically, individuals who are at least 50 years old and. Starting in 2024, the $1,000 amount will be adjusted annually for inflation just like the base amount.